As a grad student, finding enough funding can impact your present and future. A Graduate PLUS loan is an option that can help you afford tuition and fees for your education and get through the academic year.

Grad PLUS Loans are offered by the U.S. Department of Education for graduate and professional students. They are also known as Direct PLUS Loans as they're part of the federal Direct loan program. Since Grad PLUS loans are federal, they qualify for benefits such as loan forgiveness and income-based repayment. They also have fixed interest rates and flexible Grad PLUS loan limits.

But when taking out any student loan, you’ll want to fully understand what you’re getting yourself into. Below is everything you need to know about Grad PLUS Loans.

Grad PLUS loans are one of three main options for graduate student loans. The other two options are Federal Direct Unsubsidized loans and private student loans.

Because Grad PLUS Loans are Direct PLUS Loans, they are still considered federal student loans; however, you must complete a separate application for them. The Grad PLUS Loan has a fixed interest rate throughout the life of the loan, a perk of interest rates on federal student loans.

PLUS Loan limits are also flexible, which allow you to pay for your entire cost of attendance if you’re eligible.

Graduate PLUS Loans operate a little bit differently than other federal student loans and private student loans.

1. Grad PLUS Loans require an application. In addition to filing a Free Application for Federal Student Aid (FAFSA), you’ll be required to fill out another application to receive Grad PLUS Loans.

Most schools require you to apply for a Grad PLUS Loan online at StudentLoans.gov, though a few schools have their own applications.

2. Grad PLUS Loans are based on a credit check. Unlike the subsidized loans that are available for undergraduate degrees, Grad PLUS Loans aren’t based on financial need. Instead, they require a credit check and a good credit history.

This is why you must fill out an application. If you have an adverse credit history, you’ll have to jump through a few more hoops to see if you’re eligible for a Grad PLUS Loan.

3. Grad PLUS Loans carry a higher interest rate than other federal student loans. For the 2023-24 academic year, the Grad PLUS loan has a fixed interest rate of 8.05%. PLUS Loans are typically taken out after unsubsidized loans due to the high interest rate. Additionally, there is a loan fee of 4.228%.

When comparing Grad PLUS Loans to private student loans, you can often get a better interest rate if you have a good credit score. The trade-off is giving up the flexible repayment plans offered for federal student loans. Which can give you options for lower monthly payments.

4. Grad PLUS Loans have flexible repayment plans. A Grad PLUS Loan is eligible for all of the income-based repayment plans. In addition to this, PLUS Loan payments are deferred when you’re enrolled in an accredited school at least half-time.

** Rates as of June 2024

Grad PLUS Loans are available to student loan borrowers who meet the following eligibility requirements:

If you have poor credit, it’s not necessarily impossible to get a Grad PLUS Loan.

If “adverse credit history” sticks out on this list, you may be wondering what exactly this entails. Examples of adverse credit history include:

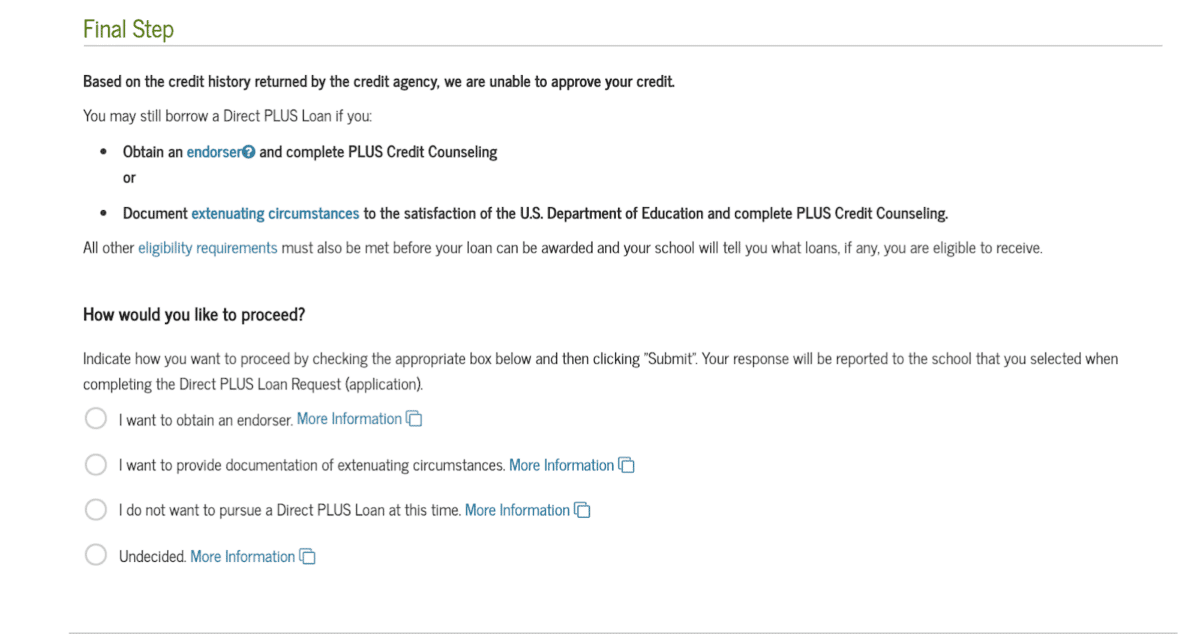

You can still be eligible for a Grad PLUS Loan if you get a cosigner or provide documentation to the Department of Education that shows extenuating circumstances regarding your credit history.

In either case, you’ll be required to complete credit counseling, which is provided at StudentLoans.gov.

The amount you can borrow with Grad PLUS Loans is the cost of attendance minus any other financial aid you receive. The cost of attendance is determined by the school but can include:

Miscellaneous personal expenses may also be included in the total cost of attendance.

There’s no Grad PLUS Loan limit or maximum amount to how much you can borrow — only the formula mentioned above. This means you could fund your entire program with a Grad PLUS Loan if needed.

The Grad PLUS Loan application process takes about 20 minutes to complete.

It doesn’t include the FAFSA, which must be filled out prior to applying for a Grad PLUS Loan. Before you begin the application, you’ll need:

Lastly, if you’re requesting a specific amount, figure that number out beforehand. You can also check a box that says “I want to borrow the maximum Direct PLUS Loan amount for which I am eligible, as determined by the school,” if you need full funding minus the aid you received.

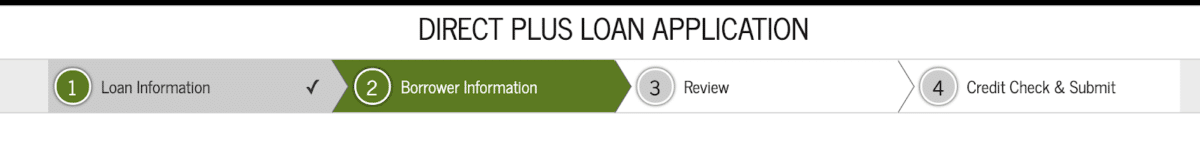

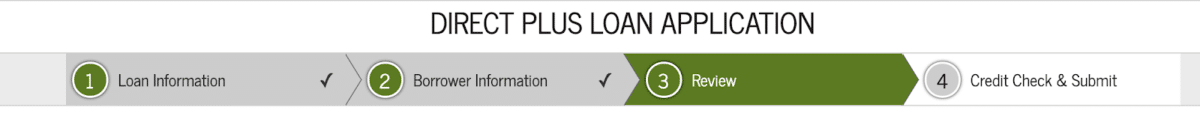

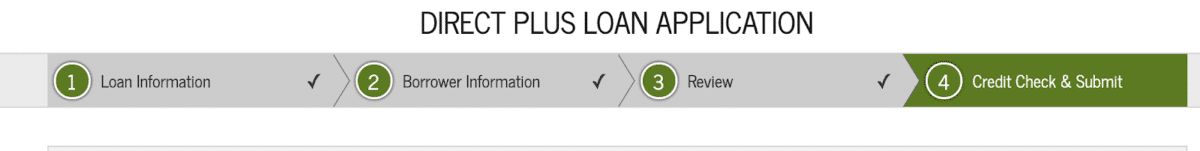

Below are the steps to take when filling out a Grad PLUS Loan application.

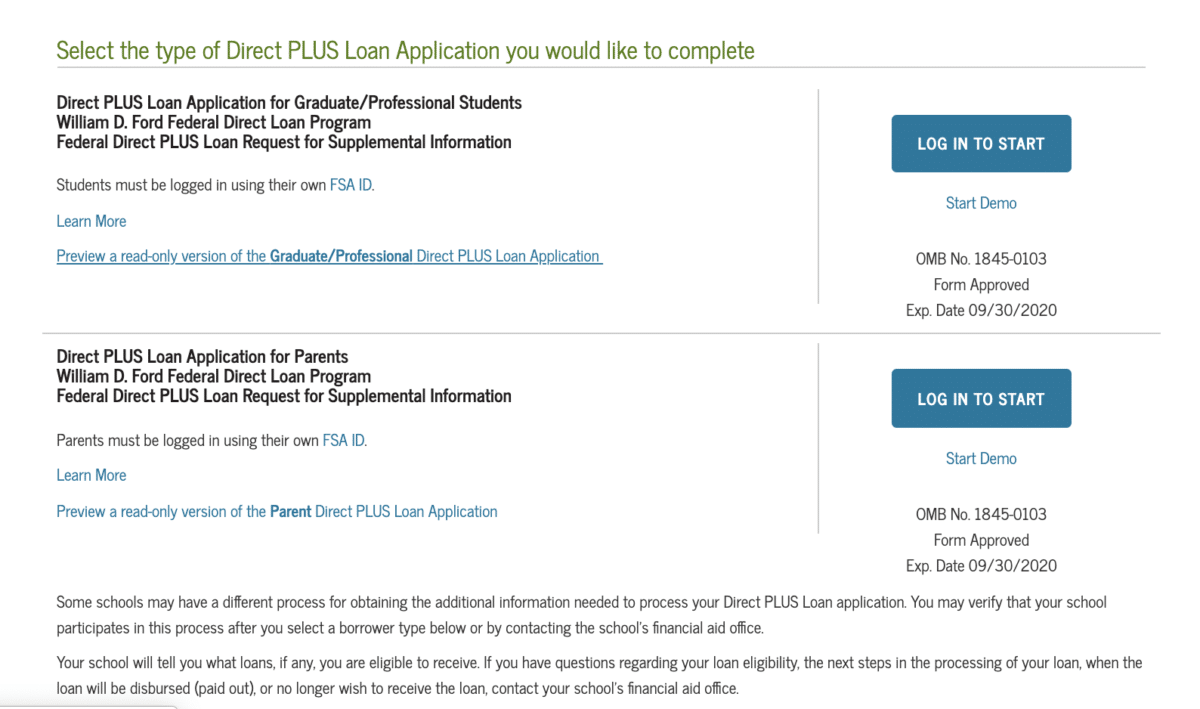

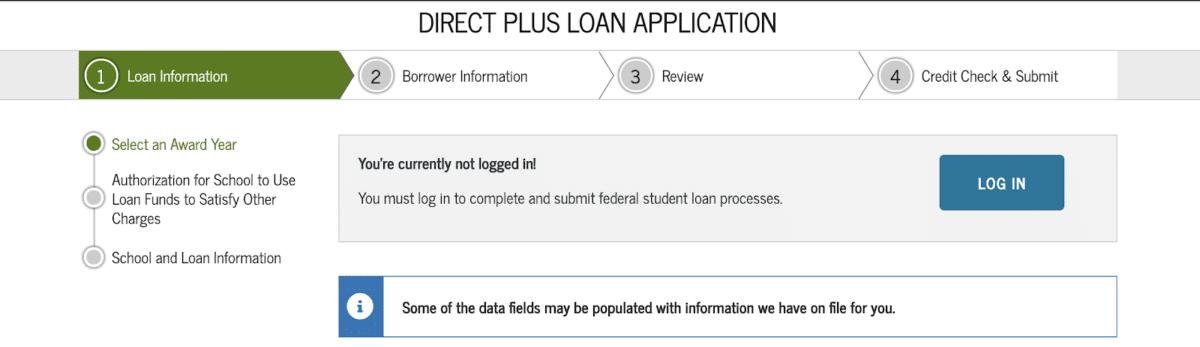

Select the type of PLUS Loan application you’d like to complete. Log in with your FSA ID.

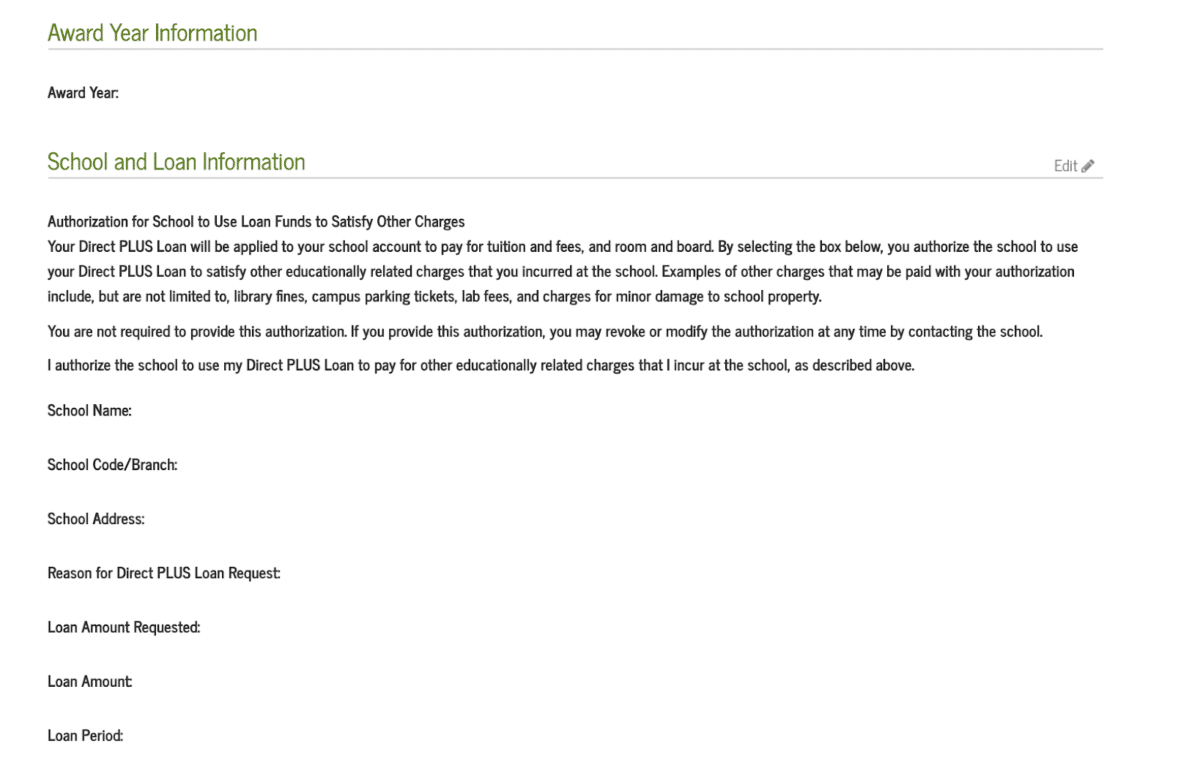

This will include the award year, authorization for the school to use funds to satisfy other charges, and school and loan information.

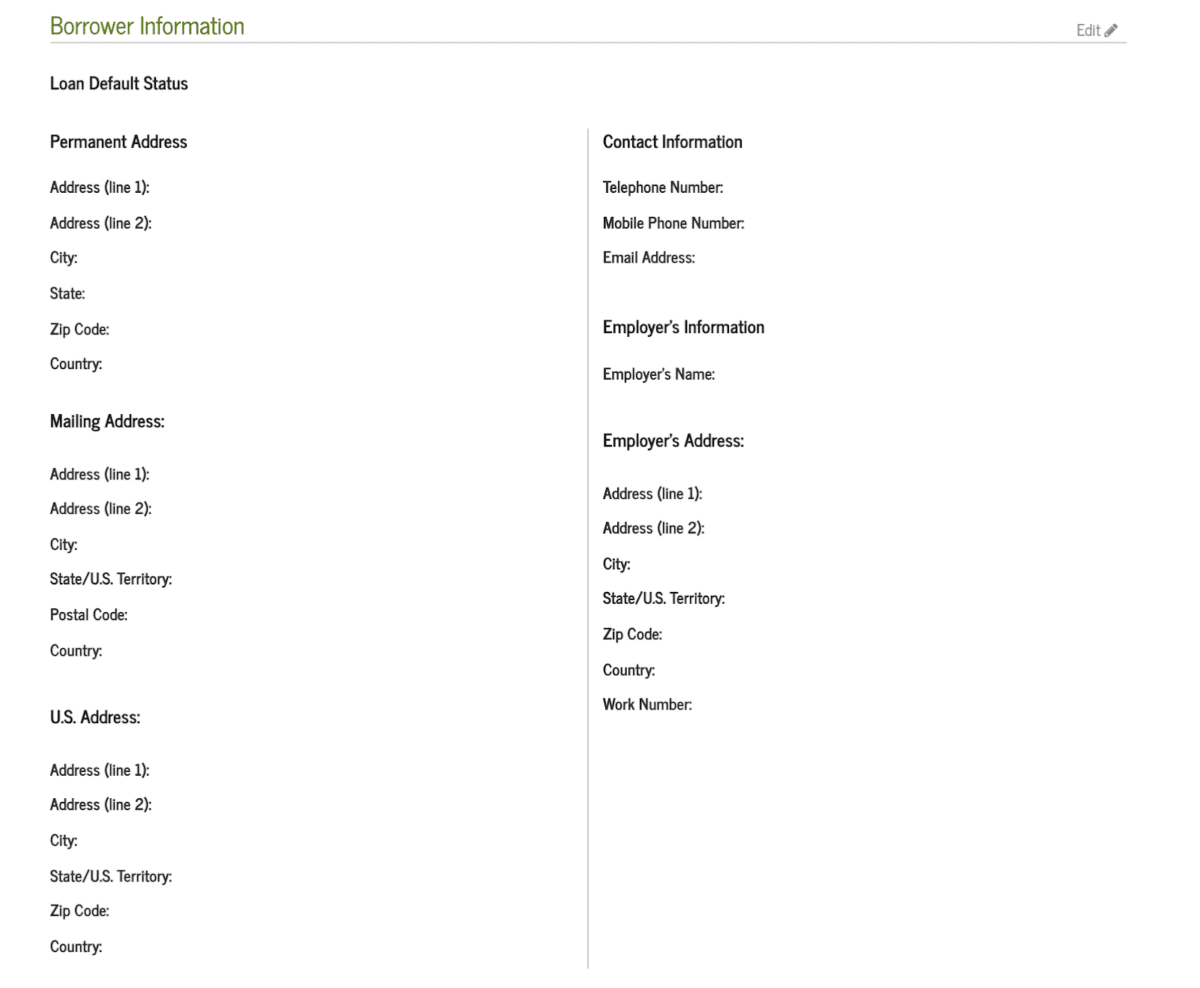

This will include your address, email, phone number and your employer's information.

Verify that everything is correct, especially the contact information.

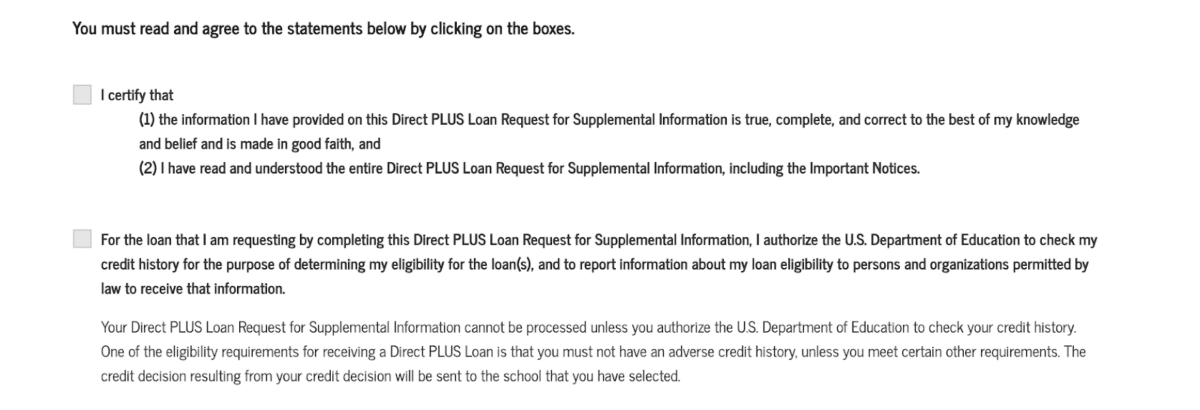

You’ll need to allow the U.S. Department of Education to run a credit check. Be sure you don’t have a freeze on your credit report before you click this approval.

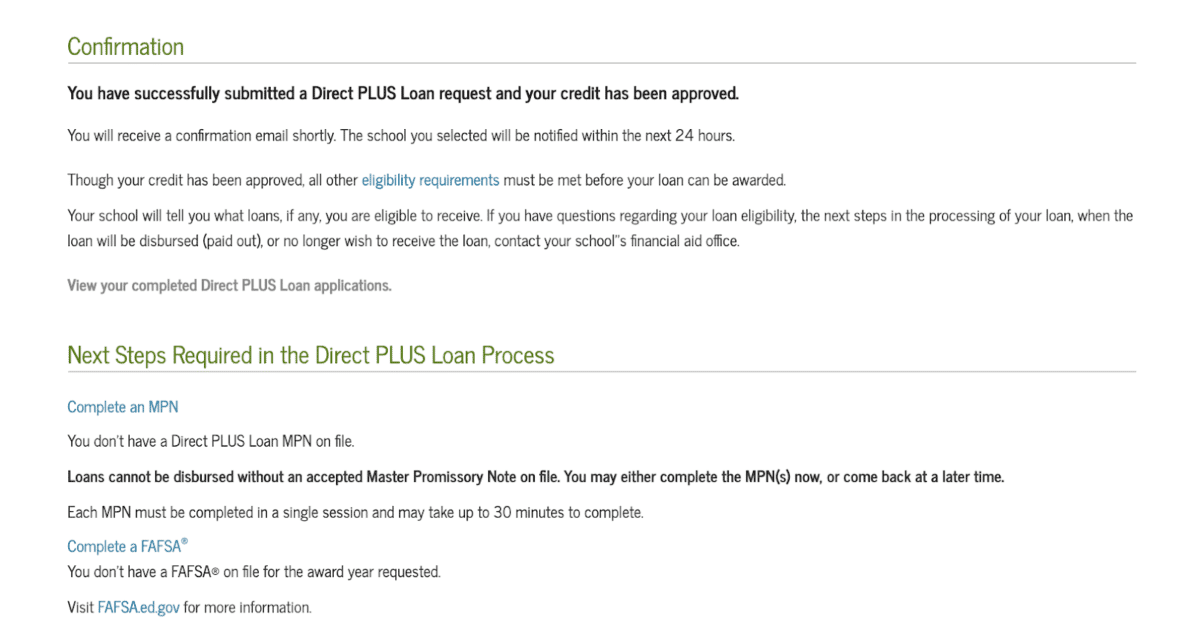

Once you submit your application, you’ll receive a notification if your credit check was accepted or declined. You should remain on the application page for this notification.

If your credit check was accepted, you’ll be asked to sign a Master Promissory Note (MPN). Your school will be notified within 24 hours of your application and will contact you about your loans.

Even with your credit approved, the school will still check your eligibility requirements prior to awarding your Grad PLUS Loan.

If you have questions about this, contact your school's financial aid office.

If your credit check was declined, you’ll need to decide how you want to proceed with the application. You can obtain an endorser, explain the circumstances, decide not to pursue a Grad PLUS Loan or remain undecided.

There’s a possibility when you submit your application that you’ll receive a “pending” notification instead of being immediately accepted or declined.

If this happens, it’s because the Department of Education’s program couldn’t verify your identity or your employer's information. You’ll need to contact the Student Loan Support Center if this occurs.

After you apply for and receive your Grad PLUS Loan, you should start examining the repayment plan options in detail.

Repayment starts immediately after graduating. Once you enter repayment, any unpaid interest capitalizes. This means it’s added to the total principal balance of the loan.

Ideally, you can avoid your interest capitalizing by paying it off while in school. If you feel like you need to defer your payments after graduating, reach out to your servicer immediately about deferment and forbearance options.

Unlike Parent PLUS Loans, Grad PLUS Loans have a variety of repayment plans available. You can choose between the following repayment plans based on your needs:

All of these payment plans are designed to work with your current financial needs so you can afford your loan payment. If you know how much you aim to borrow, check out the Student Loan Planner® calculator to plan for your future repayment.

Graduate students have more options than just the Grad PLUS Loan. The three main choices for graduate student loans include:

Before diving into student loans to pay for graduate school, look into scholarships and fellowships. You should also look into state-specific student loan repayment programs when searching for aid.

There are many forms of funding out there that don't require you to pay them back. These should always be the first options before student loans.

As you develop a plan to pay for graduate school, it can be helpful to look into the future. Look at your expected salary and the amount of student loan debt you’re going to take on.

Consider a pre-debt consultation if you want more guidance before taking on graduate school financing.

Disclosures

For 100k or more. Fixed 4.74 - 9.99% APRDisclosures

$1,000 Bonus For 100k or more. $300 for 50k to $99,999 Fixed 4.99 - 10.24% APPR Variable 5.28 - 10.24% APRDisclosures

$1,000 Bonus For 100k or more. $200 for 50k to $99,999 Fixed 4.89 - 9.74% APR Variable 5.89 - 9.74% APRDisclosures

$1,050 Bonus For 100k+, $300 for 50k to 99k. Fixed 5.24 - 9.15% APR Variable 5.34 - 9.25% APRDisclosures

$1,275 Bonus For 150k+, $300 to $575 for 50k to 149k. Fixed 4.84 - 8.44% APR Variable 5.28 - 8.99% APRDisclosures

$1,250 Bonus For 100k+, $350 for 50k to 100k. $100 for 5k to 50k Fixed 4.84 - 10.99% APR Variable 5.28 - 12.45% APR Show All 6 lendersTake our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Bethany McCamishBethany McCamish works as a freelance writer and graphic designer in the personal finance and lifestyle content space. She is also the owner of His and Her FI, a personal finance blog and podcast, which has brought her coverage from CNBC, Milk and Honey, and a Plutus Award nomination. She believes that transparency and conversations about money are essential in gaining control of finances. When she is not working, she can be found hiking with her massive dog or traveling the world and taking photographs.

Comments are closed.

SoFi: Fixed rates range from 4.74% APR to 9.99% APR with 0.25% autopay discount and 0.25% direct deposit discount. Variable rates range from 5.99% APR to 9.99% APR with 0.25% autopay discount and 0.25% direct deposit discount. Unless required to be lower to comply with applicable law, Variable Interest rates will never exceed 13.95% (the maximum rate for these loans). SoFi rate ranges are current as of 09/17/24 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term you select, evaluation of your creditworthiness, income, presence of a co-signer and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay and Direct Deposit are not required to receive a loan from SoFi. You may pay more interest over the life of the loan if you refinance with an extended term.

0.25% Direct Deposit Discount: Terms and conditions apply. Offer good for Student Loan Refinance (SLR) borrowers that apply for a new SLR on or after 9/17/2024. To be eligible to receive the 0.25% interest rate reduction offer: You must (1) Complete a Student Loan refinance application with SoFi beginning September 17, 2024; (2) Be approved by SoFi for the loan meeting all SoFi’s underwriting criteria; (3) Have either an existing SoFi Checking and Savings account, a SoFi Money cash management account or open a new SoFi Checking and Savings account within 30 days of funding the new loan, AND receive a direct deposit of at least $1,000 to the account within the first 30 days of funding the new loan (“Direct Deposit Account”); (4) Be the primary SLR account holder. If eligible at SoFi’s sole discretion, you will receive this discount during periods in which you have received direct deposits of at least $1,000 every 30 days to a Direct Deposit Account. This discount will be removed during periods in which SoFi determines you have not received at least $1,000 every 30 days in direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to obtain a Loan. This discount lowers your interest rate but does not change the amount of your monthly payment. SoFi reserves the right to change or terminate this Rate Discount Program to unenrolled participants at any time without notice.

Student Loan Planner® Bonus Disclosure

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Splash Financial, Inc. (NMLS #1630038), licensed by the DFPI under California Financing Law, license # 60DBO-102545

Terms and conditions apply. Loan or savings calculators are offered for your own use and the results are based on the information you provide. The results of this calculator are only intended as an illustration and are not guaranteed to be accurate. Actual payments and figures may vary. Splash Financial loans are available through arrangements with lending partners. Your loan application will be submitted to the lending partner and be evaluated at their sole discretion. For loans where a credit union is the lender or a purchaser of the loan, in order to refinance your loans, you will need to become a credit union member. The Splash Student Loan Refinance Program is not offered or endorsed by any college or university. Neither Splash Financial nor the lending partner are affiliated with or endorse any college or university listed on this website. You should review the benefits of your federal student loan; it may offer specific benefits that a private refinance/consolidation loan may not offer. If you work in the public sector, are in the military or taking advantage of a federal department of relief program, such as income-based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans. Splash Financial and our lending partners reserve the right to modify or discontinue products and benefits at any time without notice. To qualify, a borrower must be a U.S. citizen and meet our lending partner’s underwriting requirements. Lowest rates are reserved for the highest qualified borrowers. Products may not be available in all states. The information you provide is an inquiry to determine whether Splash’s lending partners can make you a loan offer but does not guarantee you will receive any loan offers. If you do not use the specific link included on this website, offers on the Splash website may include offers from lending partners that have a higher rate. This information is current as of July 18, 2024.

Rates are subject to change without notice. Not all applicants will qualify for the lowest rate. Lowest rates are reserved for the most creditworthy applicants and will depend on credit score, loan term, and other factors. Lowest rates may require an autopay discount of 0.25%. Variable APRs and amounts subject to increase or decrease.

Fixed APR: Annual Percentage Rate (APR) is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rate options range from 4.99% APR (with autopay) to 10.24% APR (without autopay) and will vary based on application terms, level of degree and presence of a co-signer.

Variable APR: Annual Percentage Rate (APR) is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Variable rate options range from 5.28% APR (with autopay) to 10.24% APR (without autopay) and will vary based on application terms, level of degree and presence of a co-signer. Variable rates are derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001).

The minimum monthly payment of $100 while in the Residency Period may not pay all

of the interest due each month, which will likely result in negative amortization and a

larger principal balance when you enter the Full Repayment Period. Dental residents

and fellows are unable to receive additional tuition liabilities for the duration of their

Residency Period.

Splash: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner. Lowest rates displayed may include an autopay discount of 0.25%.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided. Customers who are approved for and close a loan will receive the $300-$500 bonus through Splash Financial. The amount of the bonus will depend on the total loan amount disbursed. There is a limit of one bonus per borrower. This offer is not valid for current Splash customers who refinance their existing Splash loans, customers who have previously received a bonus, or with any other bonus offers received from Splash via this or any other channel. If the applicant was referred using the referral bonus, they will not receive the bonus provided via the referring party. Additional terms and conditions apply.

For the $1,000 bonus associated with refinancing at least $100,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

THIS IS AN ADVERTISEMENT. YOU ARE NOT REQUIRED TO MAKE ANY PAYMENT OR TAKE ANY OTHER ACTION IN RESPONSE TO THIS OFFER.

Earnest: $1,000 for $100K or more, $200 for $50K to $99.999.99. For Earnest, if you refinance $100,000 or more through this site, $500 of the $1,000 cash bonus is provided directly by Student Loan Planner. Rate range above includes optional 0.25% Auto Pay discount.

Earnest Bonus Offer Disclosure:

Terms and conditions apply. To qualify for this Earnest Bonus offer: 1) you must not currently be an Earnest client, or have received the bonus in the past, 2) you must submit a completed student loan refinancing application through the designated Student Loan Planner® link; 3) you must provide a valid email address and a valid checking account number during the application process; and 4) your loan must be fully disbursed.

You will receive a $1,000 bonus if you refinance $100,000 or more, or a $200 bonus if you refinance an amount from $50,000 to $99,999.99. For the $1,000 Welcome Bonus offer, $500 will be paid directly by Student Loan Planner® via Giftly. Earnest will automatically transmit $500 to your checking account after the final disbursement. For the $200 Welcome Bonus offer, Earnest will automatically transmit the $200 bonus to your checking account after the final disbursement. There is a limit of one bonus per borrower. This offer is not valid for current Earnest clients who refinance their existing Earnest loans, clients who have previously received a bonus, or with any other bonus offers received from Earnest via this or any other channel. Bonus cannot be issued to residents in KY, MA, or MI.

Interest Rate Disclosure

Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.44% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Variable rates range from 6.24% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 8.95% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account.

Auto Pay Discount Disclosure

You can take advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment. The interest rate reduction for Auto Pay will be available only while your loan is enrolled in Auto Pay. Interest rate incentives for utilizing Auto Pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. For multi-party loans, only one party may enroll in Auto Pay.

Skip a Payment Disclosure

Earnest clients may skip one payment every 12 months. Your first request to skip a payment can be made once you’ve made at least 6 months of consecutive on-time payments, and your loan is in good standing. The interest accrued during the skipped month will result in an increase in your remaining minimum payment. The final payoff date on your loan will be extended by the length of the skipped payment periods. Please be aware that a skipped payment does count toward the forbearance limits. Please note that skipping a payment is not guaranteed and is at Earnest’s discretion. Your monthly payment and total loan cost may increase as a result of postponing your payment and extending your term.

Student Loan Refinancing Loan Cost Examples

These examples provide estimates based on payments beginning immediately upon loan disbursement. Variable APR: A $10,000 loan with a 20-year term (240 monthly payments of $72) and a 5.89% APR would result in a total estimated payment amount of $17,042.39. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 20-year term (240 monthly payments of $72) and a 6.04% APR would result in a total estimated payment amount of $17,249.77. Your actual repayment terms may vary.Terms and Conditions apply. Visit https://www.earnest. com/terms-of-service, e-mail us at hello@earnest.com, or call 888-601-2801 for more information on our student loan refinance product.

Student Loan Origination Loan Cost Examples

These examples provide estimates based on the Deferred Repayment option, meaning you make no payments while enrolled in school and during the separation period of 9 billing periods thereafter. Variable APR: A $10,000 loan with a 15-year term (180 monthly payments of $157.12) and an 11.69% APR would result in a total estimated payment amount of $21,290.40. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $173.51) and an 13.03% APR would result in a total estimated payment amount of $22,827.79. Your actual repayment terms may vary.

Earnest Loans are made by Earnest Operations LLC or One American Bank, Member FDIC. Earnest Operations LLC, NMLS #1204917. 535 Mission St., Suite 1663, San Francisco, CA 94105. California Financing Law License 6054788. Visit earnest.com/licenses for a full list of licensed states. For California residents (Student Loan Refinance Only): Loans will be arranged or made pursuant to a California Financing Law License.

One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Earnest loans are serviced by Earnest Operations LLC with support from Navient Solutions LLC (NMLS #212430). One American Bank and Earnest LLC and its subsidiaries are not sponsored by or agencies of the United States of America.

© 2021 Earnest LLC. All rights reserved.

Student Loan Planner® Bonus Disclosure:

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Laurel Road: If you refinance more than $250,000 through our link and Student Loan Planner receives credit, a $500 cash bonus will be provided directly by Student Loan Planner. If you are a member of a professional association, Laurel Road might offer you the choice of an interest rate discount or the $300, $500, or $750 cash bonus mentioned above. Offers from Laurel Road cannot be combined. Rate range above includes optional 0.25% Auto Pay discount.

Laurel Road Bonus Offer Disclosure:

Rates as of 8/15/24. Rates Subject to Change. Terms and Conditions Apply. All products subject to credit approval. Laurel Road disclosures. To qualify for this Laurel Road Welcome Bonus offer: 1) you must not currently be an Laurel Road client, or have received the bonus in the past, 2) you must submit a completed student loan refinancing application through the designated Student Loan Planner® link; 3) you must provide a valid email address and a valid checking account number during the application process; and 4) your loan must be fully disbursed. If a borrower is eligible for and chooses to accept an interest rate promotional offer due to that borrower’s membership in a professional association, the borrower will not be eligible for the cash bonus from Laurel Road. However, the borrower can still be eligible for the Student Loan Planner® bonus if they qualify under the “Student Loan Planner® Bonus Disclosure terms below.” If you opt to receive the cash bonus incentive offer, you will receive a $1,050 bonus if you refinance $100,000 or more, or a $300 bonus if you refinance an amount from $50,000 to $99,999.99. For the $1,050 Welcome Bonus offer, $500 will be paid directly by Student Loan Planner® via Giftly. Laurel Road will automatically transmit $550 to your checking account after the final disbursement. For the $300 Welcome Bonus offer, Laurel Road will automatically transmit the $300 bonus to your checking account after the final disbursement. There is a limit of one bonus per borrower. This offer is not valid for current Laurel Road clients who refinance their existing Laurel Road loans, clients who have previously received a bonus, or with any other bonus offers received from Laurel Road via this or any other channel.

You can take advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment. The interest rate reduction for Auto Pay will be available only while your loan is enrolled in Auto Pay. Interest rate incentives for utilizing Auto Pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. For multi-party loans, only one party may enroll in Auto Pay

Student Loan Planner® Bonus Disclosure

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

ELFI: If you refinance over $150,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided on https://www.elfi.com/student-loan-planner. Customers who are approved for and close a loan will receive the $300-$775 bonus through a reduction in the principal balance of their ELFI loan when your loan has been disbursed. The amount of the bonus will depend on the total loan amount disbursed. In order to receive this bonus, customers will be required to complete and submit a W9 form with all required documents. Taxes are the sole responsibility of the recipient. There is a limit of one bonus per borrower. This offer is not valid for current ELFI customers who refinance their existing ELFI loans, customers who have previously received a bonus, or with any other bonus offers received from ELFI via this or any other channel. If the applicant was referred using the referral bonus, they will not receive the bonus provided via the referring party. If the applicant becomes an ELFI customer, they may participate in the referral bonus by becoming the referring party. Additional terms and conditions apply.

For the $1,275 bonus associated with refinancing at least $150,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Credible: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided on www.credible.com.

All bonus payments are by e-gift card. See terms. The amount of the bonus will depend on the total loan amount disbursed. In order to receive this bonus, customers will be required to complete and submit a W9 form with all required documents. Taxes are the sole responsibility of the recipient. A customer will only be eligible to receive the bonus one time. New applicants are eligible for only one bonus. Additional terms and conditions apply.

For the $1,250 bonus associated with refinancing at least $100,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Student loan refinance interest disclosure

The lenders on the Credible.com platform offer fixed rates ranging from 4.94% – 10.99% APR. Variable interest rates offered by the lenders on Credible.com range from 5.28% – 12.45% APR. Variable rates will fluctuate over the term of the borrower’s loan with changes in the Index rate. The Index will be either LIBOR, SOFR, or the Prime Rate of interest as published in the Wall Street Journal (WSJ). The maximum variable rate on the Education Refinance Loan is the greater of 21.00% or Prime Rate plus 9.00%. Rates are subject to change at any time without notice. Your actual rate may be different from the rates advertised and/or shown above and will be based on factors such as the term of your loan, your financial history (including your cosigner’s (if any) financial history) and the degree you are in the process of achieving or have achieved. While not always the case, lower rates typically require creditworthy applicants with creditworthy cosigners, graduate degrees, and shorter repayment terms (terms vary by lender and can range from 5-20 years) and include loyalty and Automatic Payment discounts, where applicable. Loyalty and Automatic Payment discount requirements as well as Lender terms and conditions will vary by lender and therefore, reading each lender’s disclosures is important. Additionally, lenders may have loan minimum and maximum requirements, degree requirements, educational institution requirements, citizenship and residency requirements as well as other lender-specific requirements.

Advertising DisclosureThis post may contain affiliate links, which means Student Loan Planner may receive a commission, at no extra cost to you, if you click through to make a purchase. Please read our full disclaimer for more information. In some cases, you could obtain a better deal from our advertising partners than you could obtain by utilizing their services or products directly. This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author alone.

Life gets better when you know what to do with your student loans. Book a one-hour consulting call today. Your future self will thank you.

© Copyright 2016-2024 Student Loan Planner®. All Rights Reserved.

Product name, logo, brands, and other trademarks featured or referred to within Student Loan Planner® are the property of their respective trademark holders. Information obtained via Student Loan Planner® is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education.